The share of companies increasing workers’ compensation has reached an all-time high in recent years, reaching 51% by June 2022. The hardest cost to reduce is compensation. It is also the largest expense for most small employer businesses. When the cost of uncompensated inputs falls, the benefit drops and can be passed on to customers by lowering selling prices. Competition is the force that makes this happen. But when those cost inputs fall because of a slowing economy, wages generally stay the same; they are commitments to individuals. The only way payroll costs will fall is if employees are laid off or more flexible compensation components are suspended, including bonuses, 401k matches, etc. Employees who are laid off may find employment elsewhere, but very likely at a lower compensation level. And a replacement can be hired for a lower wage. This collectively lowers labor costs for companies, while unemployment levels rise for those unable to get a new job. This process takes time and contributes to the “stickiness” of labor costs, even as prices fall. Owners will be reluctant to let go of employees for whom they struggled to hire and retain staff while there was a shortage of employees.

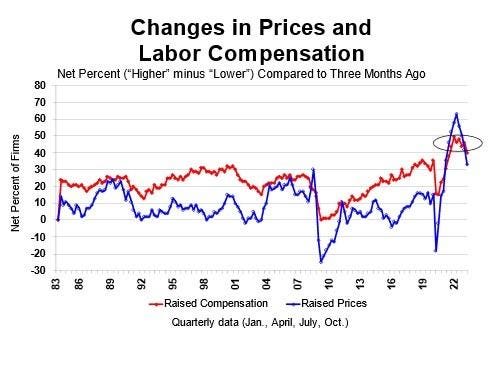

Chart 1 shows that labor costs and sales prices are strongly correlated. However, movements in the net percentage of owners raising compensation are less volatile than the percentage raising selling prices, which are easier to change than wages. In recent years, the rate of increase in price has fallen from the peak much faster than the net rate of increase offset – “sticky”. This makes it more difficult for the Fed to cut headline inflation because labor costs are the main operating expense for most small businesses. This problem varies in severity between industries.

Changes in Prices and Labor Compensation, NFIB Small Business Economic Trends

Table 1 shows the percentage of companies increasing fees and selling prices across broad industry categories. The rate of pay increases in the first quarter was highest in finance and real estate (48%), followed by construction (47%), professional services (46%) and, surprisingly, retail (45%). These firms were also among those that raised prices at very high rates, with the exception of professional services where 46% raised fees, but only 18% raised sales prices. Construction and retail led the parade of price increases (up 59%), followed by 54% in wholesale and 52% in the financial sector (higher mortgage rates).

Increased Fees and Prices by Industry, NFIB Small Business Economic Trends

Consumer spending remained solid, fending off reasons to lower prices and, in sectors such as construction and retail, providing the opportunity to increase them. The Federal Reserve’s strategy is simple: getting people to spend less, and competition for shrinking consumer spending will drive companies to lower prices. Presto, inflation is falling. Heavy government spending has boosted incomes and kept spending solid, with little tendency to slow down. The rapid rise in Federal Funds rates caused some banking problems, as depositors suddenly had other investments available that paid higher interest than savings accounts. But inflation is close to 5%, well above the inflation target of 2%. Although the FOMC voted unanimously in favor of rate hikes at their last meeting, a pause in rate hikes has become more likely as the Fed wants to give their aggressive policies a little more time to work before raising rates even further (as Volcker had to in the 1980s). doing). ). A sustained downward trend in chart 1 indicates that the strategy is working.